Sahas Urja Limited IPO Result can be checked here. Clear information about the IPO allotment status of Sahas Urja is given in our article below, please read it carefully. Sales manager NIBL ACE Capital Limited has published the company’s IPO on Sunday Morning 3rd October 2021 (17th Ashoj 2078). An online portal is available for investors to check/view the results of the IPO.

The distribution of IPO issued by Sahas Urja Limited Limited has been completed on Friday morning. The IPO result distribution work will be completed at the central office of NIBL Ace Capital Limited, the manager of share issue and sale.

According to the IPO prospectus, the refund process of the Sahas Urja Limited IPO result will begin on Wednesday after the share allotment. The credit of Sahas Urja Company IPO result shares to Demat accounts will be done within Thursday, and the stock is likely to be listed by the next Monday.

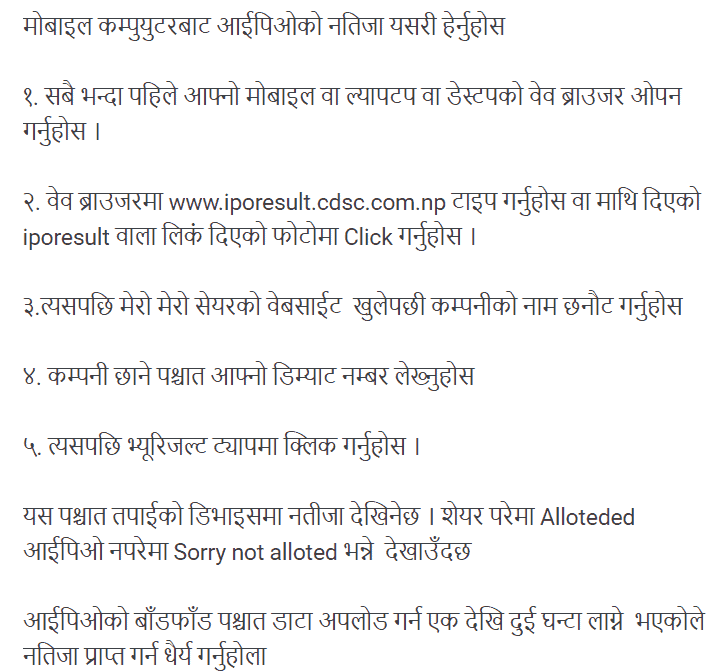

As mentioned above, a bidder is advised to log in at the direct Mero share link — meroshare.cdsc.com.np and follow the below-mentioned step by step guide:

1] Login at direct CDSC link — meroshare.cdsc.com.np

2] Select Sahas Urja IPO;

3] Enter Your Demat application number;

4] Click at ‘View Result’; button

Your Sahas Urja Limited allotment status will become available on the computer monitor or on the Smartphone screen.

( Please note the details will only be available once the Sahas Urja shares are allotted.)

As there are more applications than demand in the IPO, the Sahas Urja Limited IPO result will be distributed by round-robin. While distributing through round-robin, 7,44,000 applicants will receive shares at the rate of 10 units.

How to check Sahas Urja IPO allotment status at NIBL Capital Limited

You can also check the share allotment status on the online portal of NIBL Ace Capital Limited (https://result.niblcapital.com/), the registrar to the issue. The registrar is a Sebi-registered entity, qualified to act as such, and it processes all applications electronically, carrying out the allotment process in accordance with the prospectus.

After the issue has been completed, registrars are responsible for updating the electronic credit of shares to successful applicants, dispatching refunds, and attending to all investor-related queries.

- Go to the web portal of NIBL Ace Capital Limited Limited

2. In dropbox, select the IPO whose name will only be populated after the allotment has been completed

3. Once the company is selected, you will have to enter either your Boid number, the application number.

4. Enter the captcha and click ‘submit’.

Once you click ‘submit, the status of your application will appear on the screen. Please ensure the details that you provide are correct. It will show the number of shares you subscribed to and the number of Sahas Urja Company IPO shares allotted to you.

2% of the 8,00,000 units offered by the company were set aside for employees of the company, i.e. 16,000 units, and 5% were set aside for mutual funds. The remaining 7,44,000 units were for the general public.

Sahas Urja IPO other Details:

| IPO Issuing Company Name | Sahas Urja Limited |

|---|---|

| IPO result Date | 3rd October 2021 |

| Issue Manager | NIBL Ace Capital Limited |

| IPO Issue Date | 22nd September 2021 |

| IPO Close Date | 26th September 2021 |

| Security Type | Common Stock -IPO |

| Initiation of Refunds | 9th October 2021 |

| The credit of Shares to Demat Account | 15th October 2021 |

| IPO listing DATE | 19th October 2021 |

| Issue Size | 7,000,000 |

| Total Capital | 3,500,000,000 |

| IPO Face Value | NPR 100 |

| Total IPO Share | 35,000,000 units |

| The share allocated for mutual Investment | 3,50,000 Units |

| The share allocated for Employers | 2,10,000 Units |

| The total share allocated for individual Investor | 6,440,0000 Units |

| Total applicants | 24,74,736 |

| Total Rejected Applicants | 12,236 |

| Total approved Applicants | 24,62,500 |

| Total applied Unit | 3,44,98,39 Units |

| Total Allocated Unit | 64,40,000 |

| Total Allotted | 64,40,00 |

| IPO Result | IPO Result |