Union Life Insurance IPO result has been declared. Sales manager Prabhu Capital issued the company’s IPO on Thursday evening 15th July 2021. Investors can check/view the IPO result and allotment status through an online portal.

The distribution of IPO issued by Union Life Insurance Company Limited (ULICL) has been completed today. The IPO result distribution work has been completed at the central office of Prabhu Capital Limited, the manager of share issue and sale.

Union Life Insurance IPO Result

According to the IPO prospectus, the refund process of the Union Life Insurance IPO result will begin on Tuesday after the share allotment. The credit of Union Life Insurance IPO result shares to Demat accounts will be done within Thursday, and the stock is likely to be listed by the next Monday.

Investors can check the website of the issuing registrar, MeroShare Technologies, to see if they have received the Union Life Insurance IPO Result shares of the company they applied for.

The website of the registrar will seek certain information. On the page for allotment status, investors can use their application DEMAT or BOID number to check their allotment status on https://meroshare.cdsc.com.np/.

How to Check IPO Result of Union Life Insurance

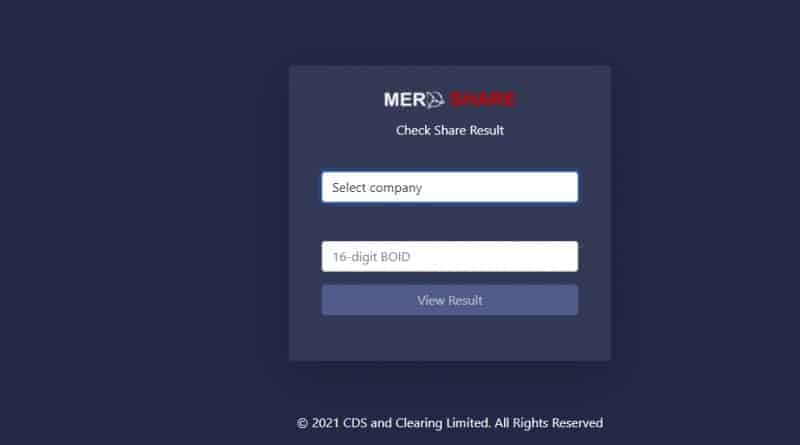

You can view the Union Life Insurance IPO results on the MeroShare website https://iporesult.cdsc.com.np/ by going to the application report and entering your Demat number or BOID number. Here is how you can check the share allocation status.

Step 1: To get allotment status for Union Life Insurance IPO, go to Meroshare’s website at https://iporesult.cdsc.com.np/

Step 2: On MeroShare, select and then from the dropdown, select ‘Union Life Insurance result’

Step 3: Enter your BOID or DMAT number and any other required details.

Step 4: You will see allotment status where the share is allotted or not marked question on the screen.

Please note the details will only be available once the Union Life Insurance IPO shares are allotted.

The issue and sale manager of the company is Prabhu Capital. ICRA Nepal has given microfinance an ICRP Issuer Rating Triple B rating for the issuance of shares. The institution shows moderate safety when it comes to medium risks associated with its credit portfolio and the timely fulfillment of its financial obligations. An official rating is valid for a period of one year after the date of issuance.

As there are more applications than demand in the IPO, the Union Life Insurance IPO result will be distributed by round-robin. While distributing through round-robin, 5,80,500 applicants will receive shares at the rate of 10 units.

Alternative website to check Union Life Insurance IPO allotment status

You can also visit the registrar website (Prabhu Capital Limited website) to check your allotment status.

- Visit the issuer website Prabhu Capital Limited https://www.prabhucapital.com/ipo

- Click on ‘Select company’ and click on ‘Union Life Insurance IPO result’. It will only appear after the allotment of shares.

- Once the company is selected, you will have to enter either your Demat number, the application number.

- Enter the captcha and click ‘submit’.

Once you click ‘submit, the status of your application will appear on the screen. Please ensure the details that you provide are correct. It will show the number of shares you subscribed to and the number of Union Life Insurance IPO shares allotted to you.

Prabhu Capital, the manager of share issue and sale of insurance, submitted the report to the board after making a pre-allotment this morning. Capital has distributed the shares as soon as it got the approval of the board.

A total of 2.182 million people had applied for the IPO. According to Capital, 4,801 of them have been canceled due to duplicate applications while 65,175 have been canceled due to mismatch of banking details. Thus, a total of 69 thousand 976 applications have been canceled.

Of the 2,112,799 applicants eligible for distribution, 5,80,500 have received IPOs at the rate of 10 lots. On this basis, out of the total number of applicants for the shares of Insurance, more than 1.62 million applicants have been left empty-handed.

According to CDSC, 92% of the total applications received so far have been received online. Out of the total applications for ordinary shares of Union Life Insurance, 21 lakh 82 thousand 775 applications have been received online. The remaining 6% have physically filled the shares by going to banks and financial institutions.