Subscribers who applied for the Balephi Initial Public Offering (IPO) can check their allotment status online. Balephi Hydropower Limited IPO result can be checked here. The company is supposed to finalize the allotment by Tuesday, April 12, 2022, as per the information provided by the issuing registrar company Global IME Capital Limited.

In case you have applied for the Balephi Hydropower IPO, then here is how you can check the status of your allotment when it gets declared. Clear information about Balephi Hydropower IPO allotment status, share price, and date is given in our article, please read it carefully.

Balephi Hydropower Limited IPO Result

Those who have applied for the public issue can check their Balephi Hydropower IPO Result online by logging in at the CDSC and Clearing Limited website —iporesult.cdsc.com.np or at the Mero share website —meroshare.cdsc.com.np. Bidders can log in at the direct Mero share link — meroshare.cdsc.com or at the direct Link CDSCs web link — https://iporesult.cdsc.com.np/ and check Balephi Hydropower IPO allotment status online.

The distribution of the IPO issued by Balephi Hydropower Limited has been completed today at 10 am. The IPO result distribution work has been completed at the central office of GLOBAL IME CAPITAL Limited Kathmandu, the manager of share issue and sale.

Balephi Hydropower IPO Result Check IPO Result Balephi Hydropower Limited

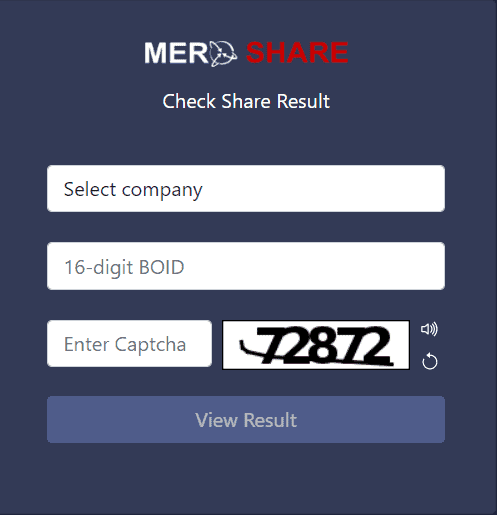

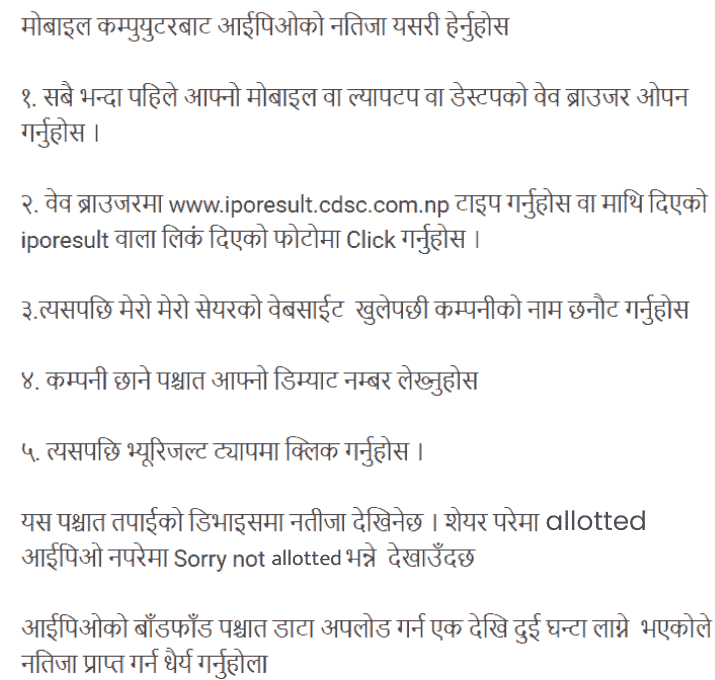

As mentioned above, an investor is advised to log in at the direct CDSC IPO result link – iporesult.cdsc.com.np and follow the below-mentioned step by step guide to check the IPO result:

1] Login at direct CDSC link – iporesult.cdsc.com.np

2] Select Balephi Hydropower result link;

3] Enter Your Demat Details;

4] Verify the captcha on the CDSC page by clicking on ‘I’m not a Robot’

4] Click on the ‘View IPO Result’ button;

The status of your Balephi Hydropower Limited allotment will be displayed on your computer monitor or smartphone screen.

(Please note that the IPO result of Balephi Hydropower Limited will not become available in Mero Share until the Balephi Hydropower Limited shares are allocated.)

According to the IPO prospectus, the refund process of the Balephi Hydropower Limited IPO Result will begin on Monday after the share allotment. The credit company IPO result shares to Demat accounts will be done within Thursday, and the stock is likely to be listed by the next Friday.

As there are more applications than demand in the IPO, the IPO result of Balephi Hydropower will be distributed by the round-robin method. According to CDSC, 2,269,416 applicants have applied to 3 1,13,700 units. The issue of the company has been oversubscribed 15.76 times. The data shows that only 1 in 15 applicants have a chance of receiving 10 shares. The remaining 21 lakh 3 thousand 68 people will be left empty-handed.

| IPO Issuing Company Name | Balephi Hydropower IPO Result |

|---|---|

| IPO result Date | 12th April 2022 |

| Registrar Name | Global IME Capital Limited |

| IPO Issue Date | 16 Chaitra 2078 |

| IPO Close Date | 21 Chaitra 2078 |

| Security Type | Common Stock -IPO |

| Initiation of Refunds | 14th April 2022 |

| The credit of Shares to Demat Account | 22th April 2022 |

| IPO listing DATE | 2nd May 2022 |

| Issue Size | 1,827,970,000 |

| Total Capital | 1,462,376,000 |

| IPO Face Value | NPR 100 |

| Total IPO Share | 18,27,970 Units |

| The share allocated for mutual Investment | 91,398 Units |

| The share allocated for Employers | 73,119 Units |

| The total share allocated for individual Investor | 16,63,453 Units |

| Total applicants | 2,269,416 |

| Total Rejected Applicants | 29,198 |

| Total approved Applicants | 21,48,295 |

| Total applied Unit | 26,222,970 Units |

| Total Allocated Unit | 16,63,453 |

| Total Allotted | 1,66,345 |

How to check Balephi Hydropower IPO Result Check status at GLOBAL IME CAPITAL Limited

Apart from the Mero share registrar’s website, applicants can also check the status of their allotment IPO result on the website of the GLOBAL IME CAPITAL Limited (https://www.globalimecapital.com/ipo-fpo-share-allotment-check

1] Login at GLOBAL IME CAPITAL’s direct link — https://www.globalimecapital.com/;

2] Select Balephi Hydropower IPO Result;

3] Enter your DEMAT BOID number;

4] Enter Demat details;

5] Click at ‘I’m not a robot; and

6] Click on the ‘Submit’ button.

Your Balephi Hydropower Limited IPO allotment status will become available on your computer monitor or on your Smartphone screen. Please ensure the details that you provide are correct. It will show the number of shares you subscribed to and the number of Balephi Hydropower Limited IPO result shares allotted to you.

ICRA Rating Nepal has given ICRA NP IR Double BB rating to Balefi Hydropower Ltd in the credit rating for the IPO issue. This indicates a moderate risk in the company’s ability to bear responsibility.

According to Mero Share data, Balefi Hydropower Limited IPO received bids for 26 crore shares as against the twenty-six lakh equity shares on offer. On the final day of bidding, the company’s public issue was subscribed 14.5 times. That means roughly one in fifteen subscribers will receive IPO shares against their bid.

You can also check the share IPO result Balephi Hydropower Limited on the online portal of, the registrar to issue the IPO result. The registrar is a Sebi-registered entity, qualified to act as such, and it processes all applications electronically, carrying out the allotment process in accordance with the prospectus.

About Balephi Hydropower Limited

Balephi Hydropower Limited is a company registered in the office of the Registrar of Companies as a public limited company in 2073. Balephi Hydropower Project with a capacity of 36 MW from the water of Balephi Khola located in Gumba and Golche VDCs of Bagmati Pradesh, Sindhupalchok District is currently under construction and the company has completed 80 percent of the construction work so far.

The company has stated that it plans to complete all construction work by 2077 BS and sell the electricity generated from the project to the transmission line of the Nepal Electricity Authority. The project will cost approximately Rs 6.78 billion. The cost per megawatt is 169 million. The project will return on investment in 8 years and 2 months.