Singati Hydropower IPO result has been declared by the Sales manager Mega Capital. Investors can check/view the IPO result through an online portal.

The IPO issued by Singti Hydro Energy Limited has been allotted. Sales manager Mega Capital distributed the IPO on Friday morning.

According to Singati Hydro’s Manager, Singati hydropower IPO result can be viewed from Mega Capital’s website https://megacapitalmarkets.com, CDSC’s MeroShare website https://meroshare.cdsc.com.np/login and Singati Hydro Energy Limited http://singatihydro.com.

Investors have to wait for a few hours to see the results even after the distribution is completed. As it takes time to update the results of the IPO on my shares, it can be seen from my shares only 4 and 5 hours after the distribution, said the sales manager.

Check IPO Result of Singati Hydropower

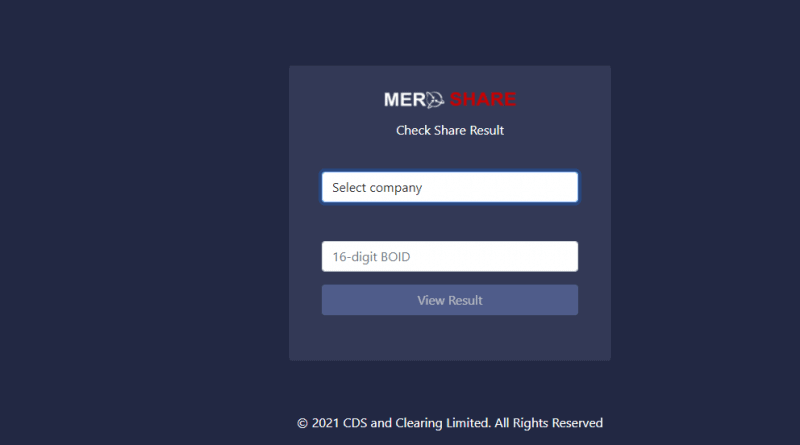

The IPO result of Singati hydropower can be viewed from the MeroShare website by going to the application report when applying for an IPO and entering your Demat number in the case of others. Here’s how you can check the share allotment status

- To check Singati Hydropower IPO allotment status, go to the Meroshare website www.iporesult.cdsc.com.np.

- On meroshare, select and then from the dropdown, select ‘Singati Hydropower IPO result’

- Enter BOID or DMAT number and other required details

- Step 4: Your result will be displayed on the screen.

1.565 million 530 people had applied for the IPO. Out of which, 1.559 million 802 applications were eligible and 5,728 applications were rejected, according to Capital. The Singati Hydropower IPO result shares have been distributed by including 1.559 million eligible applicants in the round. Out of which, 269,700 people have received shares at the same rate of 10 lots. Out of the total number of applicants, 1.295 million have been vacated.

As there are more applications than demand in the IPO, Singati hydropowr IPO result has been distributed by round robin. While distributing through round robin, 269,700 applicants have received shares at the rate of 10 lots while the remaining 12,95,830 have been vacated.

The company has issued 2.9 million shares at the face value of Rs 100 to the public since April 20. Of which, 2 percent or 58,000 units were allocated for employees and 5 percent or 145,000 units for collective investment funds. The general public has applied for the remaining 26 lakh 97 thousand lots. The company has already distributed 1.45 million shares to the locals affected by the project.

The company has stated that the construction and testing of the 25 MW Singati Khola Hydropower Project in Dolakha has been completed. It is preparing to connect the generated electricity to the national transmission line on April 30.

About Singati Hydropower

Singti Hydro Energy Limited has been operating in the office of the Registrar of Companies as a private limited company on June 20, 2008 and has been operating as per the Companies Act since June 20, 2008.

The registered office of the company is at Durbar Marg in Kathmandu and the project office is at Singati Bazaar in Kalinchok village of Dolakha.

The company had received permission from the Ministry of Energy, Government of Nepal on January 6, 2010 to generate electricity for the 25 MW Singati Khola Hydropower Project.

Care Rating Nepal has given Care NP Double B Minus (IS) rating to the company in the rating given for IPO issue. This indicates that there is a moderate risk in fulfilling financial obligations. The rating will be valid for one year from October 16, 2020, to October 15, 2021.

The company is constructing Singti Khola Hydropower Project (25 MW) based on run-of-river in Kalinchok and Bigu villages of Dolakha. The company has stated that the construction work of the project has been completed 99 percent.

Projected to increase accumulated profit to Rs 600 million in four years. The company has projected to increase its accumulated profit to Rs. 607.3 million by the fiscal year 2080/81. The company’s accumulated profit has been zero till last fiscal year 2076/77.

Similarly, it is projected to earn accumulated profit of Rs. 116.3 million in the current Fiscal Year 2077/78, Rs. 249.2 million in the Fiscal Year 2078/79 and Rs. 411.8 million in the Fiscal Year 2079/80.

Similarly, the company has projected a net worth of Rs 128.40 per share and earnings per share of Rs 11.22 by the fiscal year 2079/80. By the end of the current fiscal year, the company’s net worth per share is estimated at Rs 108.03 and earnings per share at Rs 8.3.

Based on the projected three-year net worth, the company estimates an average return of 7.99 percent. The company has set a target of starting commercial production within the first week of January, 2077 BS. The final test of the project has been completed 15 days before that date and the sale agreement has been concluded with the Nepal Electricity Authority.

The total cost of the project is projected to be Rs 5.50 billion. The production cost per megawatt is around Rs. 220 million. The general investment return period of the project is 8.16 years and the return on investment discount is 14.40 years.

The board of directors of the company has seven members. The committee will have four members from the founding shareholders, two members from the general shareholders and one professional expert.

Batu Lamichhane is the chairman of the board of directors of the company. Similarly, Dolma Lamini, Narendra Ballabh Pant, Deves Prasai and Rajni Thapa are members of the committee.

Similarly, Ganesh Karki is the executive director and Sudip Raj Gautam is the representative director. After the issuance of IPO, two directors will be selected on behalf of the general shareholders.

Future plans and strategies of Singati Hydropower

The company has made future plans and strategies to grow its business and services. The main objective of the company is to establish itself as a leading company in the development of hydropower in Nepal.

The company is committed to study the feasibility of new hydropower projects and construct other hydropower projects as well, generate electricity by making maximum use of water resources in the country as per the agreement with government agencies, and sell Sola to Nepal Electricity Authority to alleviate the current problems of the people.

The company has also made a strategy to invest in commercially viable hydropower projects to achieve its objectives.

Check out this post too

Ru Ru Jalbidhyut IPO Result – Here’s how you can check the Share allotment status