Jeevan Bikas Laghubitta IPO result has been declared. Sales manager NMB Capital Limited issued the company’s IPO on Friday morning. Investors can check/view the IPO result and allotment status through an online portal.

The distribution of IPO issued by Jeevan Bikas Laghubitta has been completed today. The IPO result distribution work has been completed at the central office of NMB Capital Limited, the manager of share issue and sale.

Jeevan Bikas Laghubitta IPO Result

According to the IPO prospectus, the refund process of the Jeevan Bikas Laghubitta IPO result will begin on Tuesday after the share allotment. The credit of Jeevan Bikas Laghubitta IPO result shares to Demat accounts will be done within Thursday, and the stock is likely to be listed by the next Monday.

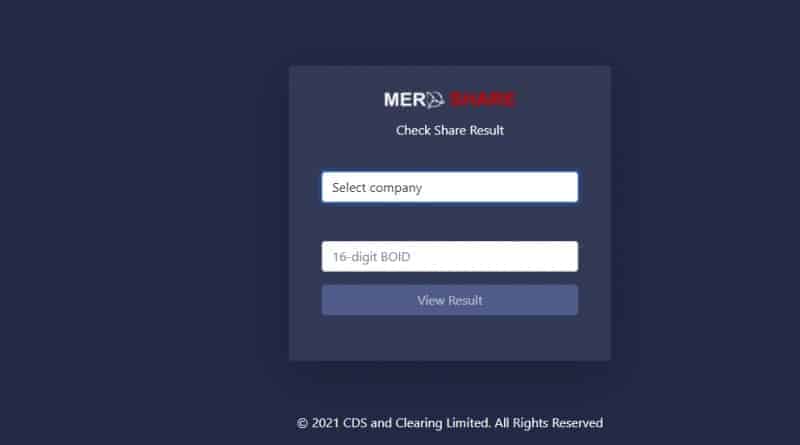

Investors can check the website of the issuing registrar, MeroShare Technologies, to see if they have received the Jeevan Bikas Laghubitta IPO Result shares of the company they applied for.

The website of the registrar will seek certain information. On the page for allotment status, investors can use their application DEMAT or BOID number to check their allotment status.

How to Check IPO Result of Jeevan Bikas Laghubitta

You can view the Jeevan Bikas Laghubitta IPO results on the MeroShare website https://iporesult.cdsc.com.np/ by going to the application report and entering your Demat number or BOID number. Here is how you can check the share allocation status.

Step 1: To get allotment status for Jeevan Bikas Laghubitta IPO, go to Meroshare’s website at https://iporesult.cdsc.com.np/

Step 2: On MeroShare, select and then from the dropdown, select ‘Jeevan Bikas Laghubitta IPO result’

Step 3: Enter your BOID or DMAT number and any other required details.

Step 4: You will see allotment status where the share is allotted or not marked question on the screen.

Please note the details will only be available once the Jeevan Bikas Laghubitta IPO shares are allotted.

As there are more applications than demand in the IPO, Jeevan Bikas Laghubitta IPO result will be distributed by round-robin. While distributing through round-robin, 2,34,115 applicants will receive shares at the rate of 10 units and the 14 applicants will receive the remaining 44 shares at the rate of 11 units.

Alternative website to check Jeevan Bikas Laghubitta Mircorfinance IPO allotment status

You can also visit the registrar website (NMB Capital Limited website) to check your allotment status.

Visit the issuer website NMB Capital Limited https://www.nmbcl.com.np/ipo

Click on ‘Select company’ and click on ‘Jeevan Bikas Laghubitta IPO result’. It will only appear after the allotment of shares.

Once the company is selected, you will have to enter either your Demat number, the application number.

Enter the captcha and click ‘submit’.

Once you click ‘submit’, the status of your application will appear on the screen. Please ensure the details that you provide are correct. It will show the number of shares you subscribed to and the number of shares allotted to you.

There have been 11 times more applications for ordinary shares sold and issued by Jeevan Bikas Laghubitta Company. According to NMB Capital Limited, the company’s share issue and sale manager, 2,63,45,500 shares have been demanded from 1,736,700 applications.

Out of the IPO applications of the organization, only 2 million 18 thousand 3 hundred and eight were eligible applicants. A maximum of 11 lots was distributed in the round and 10 lots were distributed. While distributing the IPO, 184,801 applicants received shares at the rate of 10 lots and 5 applicants received shares at the rate of 11 lots.

As there are more applications than demand in the IPO, the distribution has been done at the rate of minimum 10 lots through the round-robin method. The applications of 69,009 applicants have been rejected in the IPO of the organization. NMB Capital Limited, the manager of eviction and sale, has informed that the applications of a total of 69,009 applicants, including 3,471 suspicious applicants and 65,538 applicants from CSWA, have been rejected. A total of 1.47 million IPOs have been canceled.

The organization had issued and sold 1,977,300 IPOs at a face value of Rs 100 per share, equivalent to a total of Rs 197.73 million. Out of which, 30,420 shares, which is 0.5 percent of the total capital, has been allotted to the employees of the organization and 98,865 shares, which is to be issued to the public, is to be issued to the general public.

According to CDSC, 94% of the total applications received so far have been received online. Out of the total applications for ordinary shares of the company, 16 lakh 37 thousand 912 applications have been received online. The remaining 6% have physically filled the shares by going to banks and financial institutions.

Microfinance, which has a paid-up capital of Rs 416.70 million, has earned a net profit of Rs 563.93 million in the third quarter of the current fiscal year. The reserve fund of microfinance is Rs. 1.18 billion.

As per the audited financial statements of the Fiscal Year 2076/07, the company’s earnings per share stood at Rs. 104.97. The company’s earnings per share in the third quarter of the current fiscal year is even higher. Similarly, the company’s net worth per share was Rs 305.27.

The organization called Jeevan Vikas Samaj, which has been doing microfinance business from Fingo, was converted to microfinance as per the policy of NRB to convert Fingo into microfinance. Jeevan Bikas Laghubitta is considered as the best company in the field of microfinance.