NIBL Ace Capital is the official distributor of various Ipo companies in Nepal. Sales manager NIBL Capital Limited has allotted the Laghubitta Company IPO on Thursday evening 12th Falgun 2078. A total of 2,626,911 people had applied for the primary shares issued by the company from February 16th to February 20.

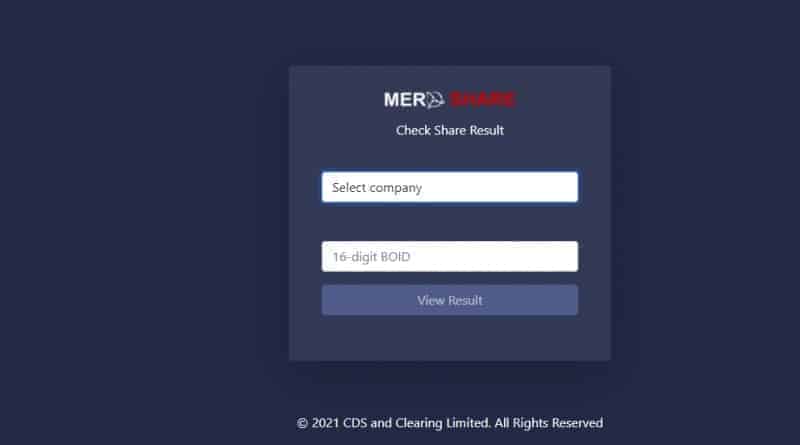

Bidders of the company can check their IPO result status by logging in at the direct Mero share link – Meroshare.cdsc.com.np

Here is a step by step guide to check IPO result:

- Login at Meroshare website – meroshare.cdsc.com.np

- Select Terhathum IPO name at the dropbox;

- Enter Demat or Boid number

- Click on the ‘Submit’ button.

- Your Terhathum Power Company IPO allotment result status will become available on your computer monitor or on your Smartphone screen.

NIBL Ace IPO result: Status check at NIBL Ace Capital Limited

As mentioned earlier, as an alternative, one can check application status online by logging in at the NIBL Ace Capital website as Link Intime is the official registrar of this public issue. The direct link to check Terhathum Power Company IPO status is www.niblcapital.com

Here is a step by step guide

- To get IPO allotment result status for Laghubitta Power Company IPO, visit www.niblcapital.com

- On NIBL Capital Limited, select and then from the dropdown, select ‘Laghubitta Power Company’

- Enter your BOID or DMAT number and any other required details.

- You will see allotment status where the share is allotted or not marked question on the screen.

- Your IPO result status will become available on your computer monitor or on your Smartphone screen.

NIBL Capital allotment Result Details

| Topic | IPO allotment |

| Company Name | Laghubitta Bittiya Limited |

| NIBL Capital IPO result | 24th February 2022 |

| IPO Open Date | 16th February 2022 |

| IPO Close Date | 20th August 2022 |

| Initiation of Refunds | 25th February 2022 |

| Credit of Shares to Demat Account | 22nd March 2021 |

| IPO listing DATE | 05th March 2021 |

| IPO result | IPO Result |

The company had opened the sale of 850,000 ordinary shares (IPO) worth 20 percent of its issued capital, or Rs 80 million. Out of which 55 or 42,000 units were secured for mutual funds, 25 or 12,000 units were secured for employees and the remaining 744,000 units were released to the public.

Rastra Utthan Laghubitta IPO result